Application For Tax Clearance Certificate - Tax Clearance Certificate | KIEC : The application for business assistance tax clearance must be completed, signed by the applicant, and submitted to the division of taxation, at the address listed on the.

Application For Tax Clearance Certificate - Tax Clearance Certificate | KIEC : The application for business assistance tax clearance must be completed, signed by the applicant, and submitted to the division of taxation, at the address listed on the.. A tax clearance certificate is a document issued by a state government agency, usually the department of revenue. Having this certificate means you are in sars' good books. A clearance certificate is necessary to prove that all tax amounts owed by the deceased, trust, or corporation have been paid. Learn how to apply for tax compliance certificate using the enhanced and simplified process of tcc application on kra itax portal today. As a precondition to or as a component of t he application process, th e applicant must provide to the state agency a current tax clearance certificate issued by the director.

Letter to apply for tax clearance sample of authorization letter to claim tax clearance certificate application letter for tax certicate tax clearance nepali i want an application letter sample for obtaining a birth certificate the letter should be addressed to sdo through champdani municipal. A tax clearance certificate is required when tendering for government business contracts, and when seeking citizenship, residency, and the extension of work permits. Learn how to apply for tax compliance certificate using the enhanced and simplified process of tcc application on kra itax portal today. Form popularity sars tax clearance certificate example form. Therefore, taxpayer can now apply online for for their tax clearance certificate from comfort of their homes or offices after.

Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax can place an online request for certificates of account status for termination or withdrawal and tax clearance letters for reinstatement.

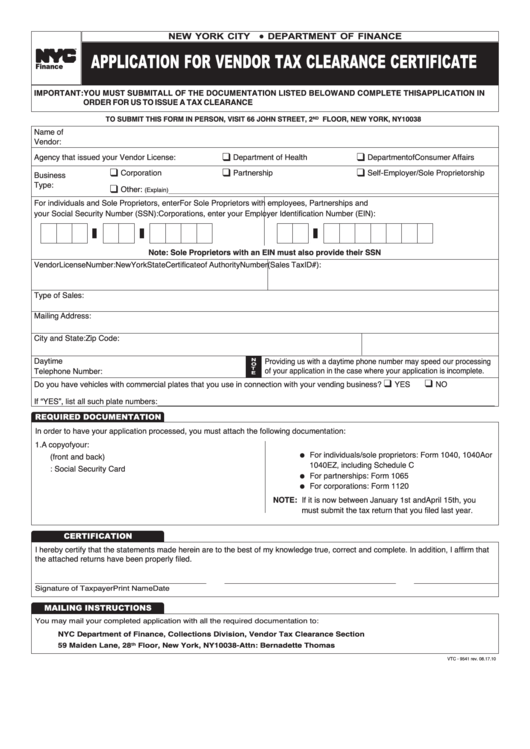

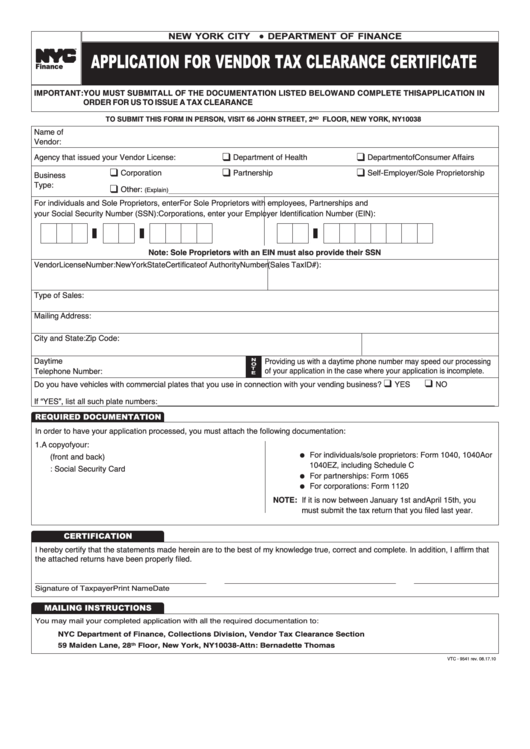

The application for business assistance tax clearance must be completed, signed by the applicant, and submitted to the division of taxation, at the address listed on the. Such applications, that will in any event be refused, simply. Form popularity sars tax clearance certificate example form. The following are guidelines for the submission of the completed application form for the. Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. A tax clearance certificate is a certificate issued by the commissioner general, valid for such period as may be specified. Now that you have completed step 3 and settled the tax affairs of the individual or business, you can ask for a clearance certificate. Published 4 april 2014 last updated 26 may 2020 — see all updates. All content is public domain unless otherwise stated. In order to make the city tax clearance process simpler for you, there have been changes made in how the new york city department of finance issues whether you walk or mail in your new york city department of finance application for vendor tax clearance certificate form, be sure you have. Download application form (form p14). The electronic tax clearance (etc) system. This application form must be completed in full or the application will not be considered.

Box, street and number or r.d. Application for tax clearance certificate. So, for abc ltd, they will be given a certificate reflecting the years 2010, 2009, and 2008. Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. The tax clearance certificate is usually for the 3 years preceding your application.

If domestic corporation, give incorporation date.

So, for abc ltd, they will be given a certificate reflecting the years 2010, 2009, and 2008. However, the can fall between n50k to n100k depending on the peculiarity. A clearance certificate is necessary to prove that all tax amounts owed by the deceased, trust, or corporation have been paid. Form popularity sars tax clearance certificate example form. .clearance certificate application form to notify us foreign resident capital gains withholding doesn't need to it provides the details of vendors so we can establish their tax residency status. Number and box number city or town 4 county state zip code. Once received by the department, if your application is accurate and complete your certificate will be issued within ten business days. Tax clearance certificate, for those who do not know, is simply a piece of official documentation that shows proof that your business has no outstanding tax. Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. If you are a foreign the foreign resident capital gains withholding clearance certificate application will request. Application form for tax clearance certificate. The application for business assistance tax clearance must be completed, signed by the applicant, and submitted to the division of taxation, at the address listed on the. Letter to apply for tax clearance sample of authorization letter to claim tax clearance certificate application letter for tax certicate tax clearance nepali i want an application letter sample for obtaining a birth certificate the letter should be addressed to sdo through champdani municipal.

Application for tax clearance (foreign company).more. Application is hereby made for a tax clearance certificate under the tax laws of lesotho. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax can place an online request for certificates of account status for termination or withdrawal and tax clearance letters for reinstatement. It certifies that a business or individual has met their tax obligations the irs also issues tax clearance certificates in certain situations, such as applications for federal contracts. A tax clearance certificate simply states that all tax liabilities are in canada, where it is common to need the tax clearance certificate in order to settle an estate, the estate's legal representative can apply for the tax certificate with a paper form or submit the application electronically in some cases.

Sworn application form (individual taxpayers).more.

Application for tax clearance (foreign company).more. Application form for tax clearance certificate. The taxpayer shall complete an application form obtained from the nearest. Sworn application form (individual taxpayers).more. However, the can fall between n50k to n100k depending on the peculiarity. A tax clearance certificate is a document issued by a state government agency, usually the department of revenue. Having this certificate means you are in sars' good books. As the applicant, both your affairs and those of connected parties to you will be this section outlines how you can apply for a tax clearance certificate. Form popularity sars tax clearance certificate example form. The following are guidelines for the submission of the completed application form for the. Learn how to apply for a tax clearance certificate via sars efiling. Tax clearance certificate, for those who do not know, is simply a piece of official documentation that shows proof that your business has no outstanding tax. Therefore, taxpayer can now apply online for for their tax clearance certificate from comfort of their homes or offices after.

Komentar

Posting Komentar